by RON PHIPPS

President, CPNA International, Ltd.

“The March to Monopoly Has Lost Its Momentum.”

There are several strategic issues facing the international honey industry. The first point I want to stress is the hopeful prospect that we are approaching the end of the two-tiered market that has plagued the industry for several years and created an unfair and uneven playing field for packers, importers and exporters. The circumvention of Chinese honey through a number of schemes such as transshipment through Indonesia, India, Malaysia, Thailand, South Korea, Taiwan, Russia and the Philippines, and the use of fraudulent customs categories, produced the two-tiered market. The 2012 termination of the exclusion of honey blends from the dumping case imposes a duty of 2.63/kg. on honey blends and closes another significant loophole in the existing anti-dumping order on Chinese honey. The march to monopoly has lost its momentum and a healthier era is on the horizon. Many packers are convinced that 2013 will see further and dramatic success in curtailing circumvention and legally punishing those who have conspired to circumvent Chinese honey in violation of U.S. law.

One consequence that we may see, as fraudulently entered honey declines in volume, is that US honey consumption may be far higher than current estimates indicate, since so much imported honey has entered the market either via transshipment or via non-honey customs classifications. Total National Honey Board assessments for imported and domestic honey are increasing each year, and 2012 declared imports were up 9% in volume over 2011. As of the end of December, the total value of imported honey for 2012 was $438 million, as reported in the Feb. 13, 2013 National Honey Report. (Table 1)

American beekeepers in the first months of 2013 have expressed growing alarm at the severe loss of bee colonies. Some beekeepers have reported losses of over 50% of their bee population. For the first time in a long time there seems to be enormous difficulty in getting an adequate number of bees to pollinate the almond groves in the California Central Valley. Despite the extremely high pollination fees, the decline of bee populations has not been reversed. Many beekeepers and apiary scientists attribute the bee decline to the reduction of pasturelands, open fields, and the encroachment by corn, soybean and canola crops on which powerful pesticides are being used.

Supply of Honey

We are witnessing a global shift in the supply of honey, especially white honey. Fifteen years ago it was typical for American beekeepers to produce 70-80 kilos per hive. In recent years, 20-25 kilos is usual and 35 kilos is regarded as a good extraction. This has affected not only supply of white honey, but has led to increased prices. As white honey from the US, Argentina and Canada, becomes both scarcer and more expensive, packers in the USA and Canada are shifting to blends that hover between white and ELA. This is a shift that will be hard to reverse. In this context, demand exceeds supply and prices are at historically high levels. Nonetheless, it would be foolish to presume there are no ceilings to honey prices, especially in the fragile and relatively stagnant economies of the western world and Japan, all suffering economic difficulties. Precisely because of the threats of continuing economic malaise and/or recession in Europe, Japan and the USA, there is a possibility of “currency wars” as nations are tempted to de-value their currencies, lower their prices and thereby, increase their exports. In the overall global context, nonetheless, demand for white honey exceeds supply and prices remain at historically high levels.

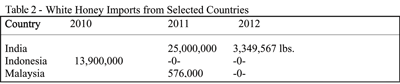

In the last few years, imports of white honey from India and Indonesia have declined sharply (Table 2), in part due to government scrutiny of imported honey by ICE/U.S. Customs and the FDA.

South America

In 2011 and 2012, the percentage and volume of US imports from the Americas, including Argentina, increased. Total imports from Argentina for the first 11 months of 2012 were about $116 million. Given the international shortage of white honey, all attention shifted to Argentina after the conclusion of the 2012 short American white honey crop. There were two major presumptions regarding Argentina’s new crop. The first was that it would be much larger and whiter than the previous crop as El Niño was bringing more rains as Argentina’s spring commenced in September. The second presumption made by some was that the end of the anti-dumping order against Argentina would lead to a proliferation of exporters, intensified competition and substantially lower prices with more 25mm, 34mm and combinations of white and ELA available. The previous Argentine crop had a color distribution of 50% 50mm, 20% White and the 30% Light Amber and darker, as reported by Javier Nascel of Nexco at the American Honey Producers Association meeting in January 2013. He also stated that Argentina, with a population of 42 million, is producing grain and soybeans to feed 400 million people. The reduction of pasturelands for the dairy and meat industries has in turn reduced Argentina’s total honey production from over 110,000 metric tons per year to a range of 65-80,000 tons per year.

We should recall that there was an abundance of flowers in the southern plains states in March and April of 2012 and in South Dakota in June. Expectations were high, but cold and rain intervened and the abundant flowers in the field did not turn into abundant honey in the drums. As a consequence, prices rose and the US white crop sold at very firm prices very quickly. As experienced members of the industry have learned from their predecessors, “don’t sell honey until it is in the drums.”

Expectations were that the Argentine crop would be large, early, white and cheap, and an atmosphere of acute speculation developed. But El Niño brought more rains and cold and Argentina’s spring crop (September-December) was substantially delayed, reduced and darkened. Contrary to expectations, the proliferation of exporters did not result in lower prices, but in higher prices in early 2013, in some cases up to 20%. Overall inflation remains at about 25% in Argentina. While the Argentine spring crop was short, darker and more expensive than some expected, the second extraction from the prairies in the central provinces during the first half of January was excellent. White honey from traditional sources like clover and alfalfa was harvested. But by the second half of January, weather had turned dry putting in jeopardy prospects for a third late summer extraction. With uncertainty about a third extraction, Argentine beekeepers are reluctant sellers. They will hold honey from the second extraction until they see whether there will be an abundant or a minimum extraction of the predominantly ELA sunflower honey produced in February (which is equivalent to August in the Northern Hemisphere) and March.

Given the above concern, estimations of the total Argentine crop may be reduced from the previous estimate of 75,000-80,000 metric tons. Since most of Argentina’s white honey is produced during the late spring and early summer periods (our June and July), it is fairly clear that Argentina will not have a huge white honey crop as expected. This is keeping prices firm and demand intense.

Already by mid February, there were substantial delays in shipment and some Argentine exporters indicate increasing doubt regarding Argentina’s ability to fulfill all the contracts made in speculation for white honey to be shipped in the first half of 2013.

Another factor lurking behind the scenes is whether there will be a proliferation of new honey exporters outside of the traditional Argentine honey and beekeeping industries. The Argentine Government has been reported by several sources to be demanding a quid pro quo such that for Argentine importers of lucrative, high profit margin high tech items to be able to import, they must export an equivalent value of Argentine products to the world market. If these reports are correct, completely new players may begin to export Argentine honey independently or in collaboration with traditional Argentine honey exporters. Such arrangements, if the reports are correct, are both in violation of World Trade Organization rules and potentially a source of price distortion. Also, lack of experience in quality control may lead to problems for new, inexperienced honey exporters in this era of Non-tariff Trade Barriers.

Brazil exported a total of 16,707 metric tons in 2012, with 11,434 tons going to the USA. As of early February, rains had come to regions producing white honey, raising expectations. However, the percentage of white honey is still small compared to Brazil’s total production. A good crop of eucalyptus is expected.

Reports from Chile indicate that the same severe drought that threatens to significantly reduce Argentina’s third extraction is affecting their 2013 crop.

Asia

Total exports from Vietnam declined in 2012 to 22,000 metric tons from 27,000 metric tons in 2011. In the first quarter of 2012, exports to the US declined significantly and then recovered later in the year. This pattern may repeat in 2013. Vietnamese honey exporters are hopeful that they will be able to export to EU countries after March 2013. The lightest color from Vietnam is in the ELA range, and most Vietnam honey is Light Amber.

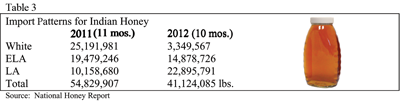

Import patterns of Indian White, ELA and LA honey over the past 2 years showed a dramatic decrease in White imports and an increase in Light Amber. (See Table 3)

In 2012, some honey shipments imported into the US from India from 4-5 major Indian exporters was found to have residues of chloramphenicol, which was typically found in Chinese honey a decade ago and led to automatic detention of Chinese honey. Other Indian, Malaysian and New Zealand shipments were found by the FDA to be adulterated with corn or cane syrup. Honey and honey/syrup blend shipments from Thailand and Hong Kong tested positive for antibiotic residues. FDA import alerts were issued in December 2012 and February 2013.

A serious and prolonged disruption of foreign production and U.S. imports for industrial honey could provoke a supply and price crisis for ELA and LA honey comparable to that faced by white honey in 2012 and 2013.

Extreme Weather Conditions

Headlines in early 2013 read “Alaska bakes and California freezes”. In the USA in 2012 we had massive forest fires in the west, one of the 3 worst droughts in a century in the late spring and summer, affecting 60% of the nation, and one of the nation’s worst floods. It was the warmest year since official U.S. records have been kept. Hurricane Sandy, which hit the northeast, has caused losses of at least $100 billion in public and private funds. New York’s governor said that “storms of the century” are occurring every year.

The severe cold and blizzards that visited the eastern half of the USA in January and February reflect global warming as the reduced freezing of the Arctic Ocean expelled frigid Arctic Air masses to the south. Just like phenomena of quantum mechanics, no one can precisely predict the specific changes in climate month by month, region by region. Nonetheless, we can predict increased volatility and severity of weather patterns that, in turn, will have significant impact upon global agricultural production. Over past decades, botanists and zoologists have witnessed a steady migration of plants and birds northwards in the Northern Hemisphere.

According to a recent National Oceanic and Atmospheric Administration (NOAA) report, global ocean and land temperatures are increasing, glaciers are melting, and the permafrost, under which are massive heat trapping gases like methane, is retreating. And with the rapid industrialization of China, India and Brazil, and likely Russia, release of heat trapping gases will accelerate. Tornadoes, hurricanes and floods are bringing human suffering and economic losses. The world average surface temperatures have increased by 1 degree F. since the 1950’s. Demand for food products is projected to exceed supply, as climate change affects agricultural production.

Political conflicts may emerge as a consequence of global warming. For example, we already see a conflict over whether to release waters into the Mississippi, which is almost too low for substantial barge transportation, or reserve that water for irrigation needs in the upper Midwest. Not only are river systems dangerously low, but water levels in the Great Lakes have fallen dramatically. The CIA has commissioned a report on the potential global conflicts that could arise from global warming’s negative impact upon agricultural production. As an example, the South Koreans, Chinese and Saudis have invested in fertile lands in the Nile River Valley. If global warming reduces agricultural production, how will the local populations respond to the need for food grown in their own areas being exported to feed people in China, Saudi Arabia or Korea? This is not merely a foreign phenomenon, but a domestic concern. There are human, economic, and social implications for global climate change.

The tremendous and continuing growth in world population and the severity and volatility of climate change are putting tremendous pressure on agricultural production. The combined populations of India and China, probably over 3 billion people, need production of grains, corn, and soybeans, and production of these crops has resulted in the reduction of pasturelands and open lands that previously provided rich and attractive nectar sources for honey such as clover and alfalfa in North and South America.

Argentina and Brazil have announced measures to limit or ban new land concessions, but sites of many transnational land purchases are in many of the world’s 20 most corrupt nations, according to Michael Kugelman’s recent report (“The Global Farmland Rush,” New York Times, Feb. 6, 2013).

Chinese Honey in North America?

With historically high prices for honey, many people in the industry knew it would be highly improbable that the anti-dumping order against Argentina would be sustained in 2013. The same was not true for China.

We should consider the future role of China in the North American honey market. For both quality and duty reasons, legal imports of Chinese honey are presently absent from the US honey market. As part of the negotiated conditions for US support of China’s entry into the World Trade Organization, China agreed to allow its dumping cases to be resolved and judged by Third Country Surrogate Analysis. It is the treatment of China as non-market economy that underlies both 1) the huge number of anti-dumping petitions against all kinds of Chinese products such as honey, solar panels and shrimp, and 2) the prohibitively high anti-dumping duty rates resulting from Third Country Surrogate Analysis. If China is treated as a market economy in anti-dumping cases, then it will become much more difficult to win high and prohibitive anti-dumping duty margins. This issue is due to be reviewed no later than 2016, which is around the corner. American honey packers are already thinking about how to regain access to Chinese honey.

It is interesting to note that Chinese companies are being encouraged to make overseas direct investments, which means buying hard assets rather than low yield U.S. treasury bonds. Already they have tried and succeeded to some degree in buying into the U.S. honey industry. They have been active in Brazil and Argentina. In Germany they are encountering some resistance as they try to buy medium-sized companies considered the backbone of the German economy. Just a few years ago, Chinese companies made a large purchase of highly fertile lands in California for which there are unrestricted water rights from the Colorado River.

In his speech to the American Honey Producer’s Association in January, 2013, attorney Mike Coursey described the confessions by Alfred L. Wolff Company employees to elaborate schemes to circumvent Chinese honey via Russia, India, Malaysia, South Korea, Mongolia, Indonesia, Taiwan, Philippines and Thailand. Honey valued at $39 million was fraudulently entered by Wolff, and in addition over 2,000 drums of honey were seized from warehouses in Minnesota, Illinois and Washington.

While substantial progress has been made over the past several years to prevent circumvention of Chinese honey, it will take several months to determine if disruption of the collusion that underlies circumvention will continue or mature in 2013. Beekeepers and packers are hopeful for decisive successes in the government’s efforts.

Identifying Honey’s Diverse Botanicals

There is an imperative to create a broader scientific data base of primary honey samples to assess the complex chemical profiles of the world’s growing diversity of honey supply. The number of significant honey exporting nations is growing as are the number of floral and botanical sources. Honey from primary and pure floral sources must be scientifically gathered, authenticated and professionally analyzed. In this regard I am pleased to note that the Vietnamese Beekeepers Association is welcoming the establishment of an international collaborative effort among private laboratories, government laboratories, independent and non-commercial academic scientists and experts to develop such a data base for Vietnam. The majority of the Vietnamese honey crop comes from honey produced from leaves rather than from flowers, according to Vietnamese beekeepers. New floral sources are also becoming significant commercial sources of honey. New adulteration tests were based largely upon samples of honey produced from an older and narrower base of floral sources. Establishment of authenticated samples is, therefore, important, and the Vietnamese Beekeeping Association, government authorities, and government and private laboratories are supportive of a collaborative study which may be conducted later this year.

The lack of an adequate data base which takes into account all the variables that affect the chemistry of honey has hurt, as Dr. Bowden pointed out, American beekeepers, not merely foreign exporters. Even the narrow base of non-authenticated samples used to establish testing parameters reveal a far greater diversity and far wider range in chemical profiles of honey than was originally hypothesized. As Dr. Bowden, who was a referee scientist for the USDA, noted, along with other scientists, there is a much wider range of variables such as floral source, climate (aridity or its opposite), elevation, season, soil content and atmospheric content that affect the photosynthetic and metabolic processes which determine the chemistry of the world’s diversity of honey. Therefore, it is both scientifically and legally imperative to do the field work necessary to acquire authenticated samples from the world’s growing honey supply and to understand the multiplicity of variables which determine the diverse chemical profiles.

Since bees and plants, whose interaction produces honey, are both vulnerable to various diseases and pests, beekeepers must protect their bees and thereby the large-scale agricultural production of food for which bees are responsible. The modes and methods of protection of bees and plants inevitably lead to residues in honey. Developing global standards that promote use of safe protective methods and residue and testing levels that take into account average daily intake are tasks that will become essential as the world becomes increasingly economically integrated and interdependent.

Opportunities for Marketing Honey as a Healthy, Natural Product

The creative marketing of honey calls for a new surge of innovation and skills. It has been said that “honey is the soul of a field of flowers.” The romanticization of the fields of production of honey is far from complete. The essential role of bees in food production and especially antioxidant rich foods needs to be further communicated. The functional attributes of honey as an ingredient, along with product development and packing, await further efforts, efforts which give us the opportunity to learn from the European honey industry, the wine industry and the growth of the tea and coffee industries. Based upon international scientific investigations, honey must develop a solid scientific foundation to put the halo of health around this heaven-given nectar of the gods. As documented by recent studies, honey consumption is favorably compared to consumption of other sweeteners. The first international symposium for honey and health reported that honey could have a positive impact on significant health concerns. Our imaginations must become more active and creative in bringing to honey the marketing innovations worthy of honey and its positive consumer messaging.